Staying Ahead of the Curve in Benefits

- ashandro

- Sep 16, 2025

- 4 min read

Updated: Sep 22, 2025

As we prepare for 2026, we're helping plan sponsors grapple with rising drug costs, chronic disease prevalence, and evolving employee expectations. Here's how you can balance sustainability with meaningful support for your team.

Drug Trends and Weight Management

The most costly drug for plan sponsors in 2023 was Ozempic, a GLP-1 medication used to treat diabetes. When Ozempic first landed in the Canadian marketplace, social media, advertising, and influencers promoted its use for weight loss. Insurers responded by ensuring that only plan members with diabetes can access this medication through their drug plans, but demand continues to be strong.

The GLP-1 landscape is expanding. There are currently 124 medications in the pipeline with clinical trials proving efficacy in treating an ever-growing list of diseases, from Crohn's Disease to osteoarthritis. We expect this expanded list of diseases to add to the cost pressures introduced by this drug class.

We are also watching the drug pipeline for promising new medications in the queue to be approved by Health Canada. The impact to plan sponsors for these drugs is expected to be medium to high as some of them are being used to treat relatively common illnesses.

Disease or indication | Estimated List Price | Potential Impact to Group Plans |

Migraine (acute) | Unknown in Canada, $1,000USD for 6 doses | Low |

Early Stage Alzheimer's Disease | Unknown in Canada, approximately $30,000 USD | Medium |

ADHD | Unknown for Canada; $5,800USD annually | Medium |

Postpartum Depression | Unknown for Canada; $16,000 USD for 14-day treatment | High |

Insurers are responding by requiring prior authorization for moderate-cost medications like Ozempic as well as enforcing biosimilar and generic pricing programs. These tactics are working. For example, spending on biosimilar drugs surpassed that of their originator counterparts for the first time in 2023.

Prepare for 2026

Educate plan members about the requirement to undergo prior authorization

Assess your philosophy on including weight management medication as a part of your benefits. Consider lifetime maximums or use Health Spending Accounts to top up core benefits offerings.

Consider drug maximums in certain situations. Employees may be able to access patient assistance programs and / or government drug programs to help top up group coverage.

Leverage programs like weight management coaching programs that may be available through your Employee and Family Assistance program or group plan.

Chronic Disease

Approximately 45% of Canadians are living with chronic disease, and benefits data suggests that many plan members are dealing with more than one chronic disease. The estimated $190B annual cost to the Canadian economy is driven by several factors.

Alarmingly, the growth rate of chronic diseases among younger plan members under the age of 30 is higher than any other demographic. Factors such as rising rates of obesity, sedentary lifestyles, unhealthy habits and lifestyles, poor mental health, and high stress levels are believed to be behind this trend.

Spotlight on Diabetes

Diabetes can be associated with cardiovascular conditions, mental health concerns, and sometimes all three. This disease contributes to 30% of strokes, 40% of heart attacks, and 50% of kidney failures leading to dialysis.

Diabetes rates are forecasted to continue to rise from 4 million Canadians in 2023 to 5 million Canadians in 2033.

Adherence to treatment is the most powerful tool we have to combat the direct and indirect costs associated with chronic disease management.

Poor adherence can be driven by high costs of treatment, not understanding how the treatment will help or why adherence is important, stigma, negative side effects, and even denial.

Prepare for 2026

New chronic disease management programs are being launched by insurer programs. Designed to help nudge plan members towards healthy habits and taking medications regularly, these programs can be effective in improving adherence and lowering plan costs.

Employers can promote healthy habits for all employees. Some chronic diseases are preventable with diet, exercise, and lifestyle changes. Lean on your Employee and Family assistance program or get creative with ways to engage your team and their families.

Women's Health

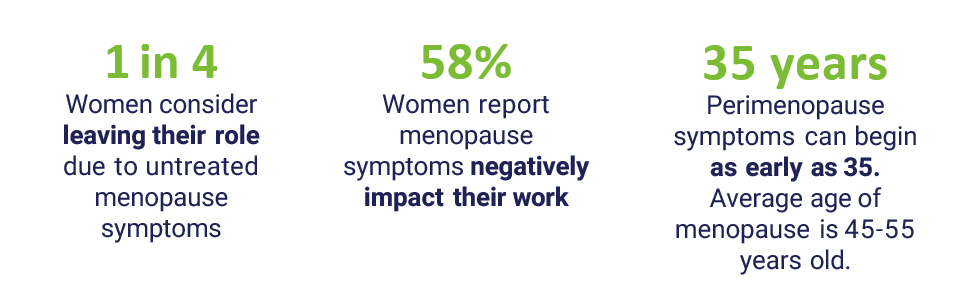

There is new awareness surrounding the impact of perimenopause on women in the workplace. Health risks such as cardiovascular disease, osteoporosis-related fractures, and type 2 Diabetes are more common in post-menopausal women.

The cognitive impact of sleep disruptions, mood disorders and brain fog also contribute to negative workplace outcomes. Consider that while an employee may not be experiencing these symptoms themself, their spouse's fitful sleep, upset and health risks can impact both the employee's productivity and plan costs.

Prepare for 2026

Consider accommodations such as flexible work policies and remote work when possible, temperature control, education and training for HR and leadership about the impact of this life stage on women and their spouses.

Leverage Insurer platforms such as Teladoc that can now be used to inquire about treatments that may lessen the impact of perimenopause and menopause. This may already be included in your benefit plan.

Consider dedicated wellness programs that can be used to provide support for women (both plan members and their spouses).

Learn more about the evolving landscape in employment law related to menopause care at our October 16th webinar. Register today to attend the live, expert-led panel discussion. All registrants will receive the recorded discussion.

Comments